Navigating the DIR Fee Hangover: How Financial Visibility Can Help Pharmacies Weather 2024’s Cashflow Crunch

Every penny counts when it comes to good pharmacy management. Knowing where to find every penny can help owners gain a complete understanding of their business’s financial health. This need for financial visibility has never been greater, as pharmacies face economic realities and headwinds from multiple fronts, including the Lingering fallout from the DIR “Hangover.” Pharmacies rang in 2024 to find themselves at serious risk of cashflow short flows, the result of a “perfect storm” of changes in DIR fee assessments. Going forward, DIR fees will be collected at the point of sale via a negotiated price. This replaces past practice, which had been to arbitrarily claw back fees long after a transaction had been settled. However, according to Drug Topics, the changes are likely to result in “higher up-front DIR fees coupled with lower patient copays, which will lead to cashflow issues and financial pain as all pharmacies will receive a low copay.” To make matters worse, the implementation of the new process overlaps with a final assessment made using the old process. The result? An expected cashflow crunch so severe it has been dubbed the “DIR Fee Hangover.” The cash flow emergency is expected to last through the first half of 2024.

- Continued Effects of DIR Fees. To be clear, the Centers for Medicare & Medicaid (CMS) did not eliminate DIR fees. Instead, the fees are now collected at the point of sale. This means DIR fees will continue to be a severe pain point for pharmacies. But, since fees are no longer imposed retroactively, pharmacists will presumably have more predictability in anticipating the impact on their bottom lines.

- Reduced Reimbursements/Stringent Contracts. Pharmacists continue to operate in an environment in which they often lose money on the medications they dispense. And it’s getting worse as payers continue to reduce reimbursement rates and offer pharmacies contracts with strict “take it or leave it” provisions.

Challenges Facing Pharmacies

In 2022, the Oregon State Pharmacy Association (OSPA) undertook an exhaustive look at pharmacy benefit manager (PBM) practices, including pharmacy reimbursements. The study found that “on a per-100 prescription basis, PBM reimbursement for the majority of claims (75 out of 100) dispensed at a typical Oregon pharmacy were insufficient to cover the pharmacy labor and drug costs.” In 2023, CBS News reported that new PBM contracts were requiring pharmacies to accept “draconian cuts to their payments for dispensing medications.” A separate analysis featured in the Washington Post included the assessment of one Minnesota pharmacy owner who noted: “I’m one bad contract from closing.”

“Everything costs more” is a common refrain as businesses and individuals alike adapt to increased prices on just about everything from electricity and heating oil to rents, food, and goods and supplies. “Inflation remains the top issue small business owners face as prices continue to rise,” noted a January 2024 “snapshot overview” by the U.S. House of Representatives Committee on Small Business. The overview noted that overall, prices today are 20% higher than they were just three years ago. It’s no wonder, then, that pharmacies are prioritizing the need for improved financial management. But with precious little time to spend delving into data and reviewing performance-related metrics, it can be difficult to gain an accurate read of a pharmacy’s financial standing.

Pharmacy Finance Solutions

Oregon State Pharmacy Association (OSPA)

“On a per-100 prescription basis, PBM reimbursement for the majority of claims (75 out of 100) dispensed at a typical Oregon pharmacy were insufficient to cover the pharmacy labor and drug costs.”

PrimeRx – Financial Management Solutions

for Today’s Pharmacy Need

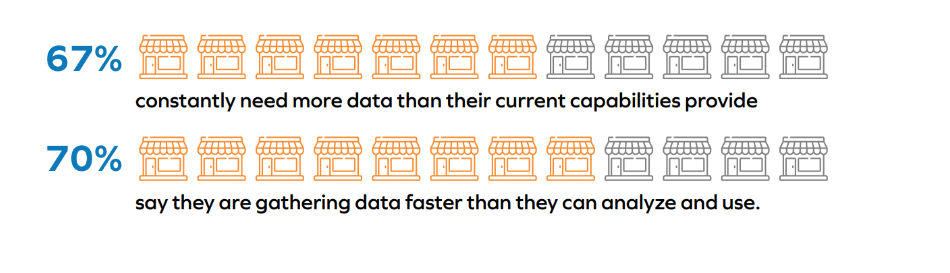

Today’s busy pharmacy never stops producing data. From point-of-sale transactions, inventory orders, claims adjudication, payer contracts, payroll, and operational expenses, the data keeps on coming. The key, though, is having the tools to wade through that data, separate the information into functional categories, provide meaningful analysis, and initiate required actions. This can be easier said than done. Research by Dell Technologies found many suffer from “data overload,” defined as “the inability to extract insights from data.”

Billing/Claims Management

Claims Submissions.

PrimeRx automatically transmits a claim to the appropriate payer once a medication has been dispensed. The claim is marked as “open” until a resolution from the payer is received.

Marked as Paid.

Claims can be quickly marked as “paid” when payment is received from a payer. PrimeRx accommodates both physical and electronic payments, carefully recording transaction amounts and details. This allows the pharmacy to track outstanding claims and facilitates good recordkeeping.

Denial Conversion – Payment for Denied Claims.

Denial conversion allows pharmacists to be paid for providing patients with medications rejected by their payers. Once a medication is rejected, PrimeRx automatically converts the claim status to “paid,” and PrimeRx reimburses the pharmacist. The pharmacist is also paid an administrative fee to cover transaction costs

Exceptions Queue

In some instances, a claim may trigger a red flag. There can be many reasons for this, including an incorrect drug code or other data entry errors. PrimeRx will hold all flagged/unprocessed claims in an “exceptions queue” and generate a reminder to the pharmacy owner/manager to review the queue contents. In most cases, a pharmacy will have already dispensed the medications covered by the problematic claim, so it’s in a pharmacy’s interest to regularly review the exceptions queue and correct all underlying issues.

Unbilled Report

Prescriptions entered into the system but never filled – or billed – present another possible source of revenue. PrimeRx quickly scans all prescriptions and identifies any that have not been acted upon. This provides the pharmacy with an opportunity to contact the patient and determine if the medication is still necessary. There are many reasons why a prescription may go unfilled, but the Unbilled Report helps avoid inadvertent oversights.

Business Reports

PrimeRx provides analysis on topics related to financial performance that include:

Business Summary

This report provides a topline overview of pharmacy performance based on the metrics an owner/manager wishes to track. A simple report, for example, might include a day-by-day listing of the number of prescriptions filled alongside the total value/profitability of those medications.

Copays Not Paid

This report can be very helpful for pharmacies that allow house charge accounts. The report identifies all patients for whom copays are still outstanding. Pharmacies can follow up with each patient for settlement

Patient Medication Adherence Report PMAR

As pharmacists are increasingly held to account for medication adherence, it’s more important than ever to identify patients who are not current with their medications. Insurers generally base assessments of patient adherence on either the Proportionate Days Coverage (PDC) ratio or the Medication Possession Ratio (MPR). The PDC estimates adherence based on the number of days for which the patient has a necessary supply of medications. The MPR, according to Pharmacy Times, “is the sum of the days’ supply for all fill of a given drug in a particular time period, divided by the number of days in the time period.”

Other Reports

Patient/Profitability Report.

Pharmacies can identify “high profit” patients by reviewing medication dispensing and profitability at the individual patient level.

Profit/Revenue Report.

Provides a detailed overview of all factors affecting pharmacy performance. This includes a summary of each insurer’s activity, among other indicators, and depicts the pharmacy’s rate of profit for each area. The report also indicates areas in which the pharmacy is showing a loss.

Top Performers.

Managers/owners can have immediate access to their pharmacy’s best-selling and most profitable drugs. This can help with revenue projections and inventory forecasting. The system can also reveal which drugs are laggards, which can also be used in making inventory decisions

Profit by Drug Category

As pharmacists are well aware, a top-selling drug is not always the most profitable. And in many instances, an in-demand drug may be cost-prohibitive for a pharmacy to hold in stock. Ozempic is a good example. The diabetes drug has soared in popularity since it was determined to be an effective option as a weight loss aid. However, the drug is costly, with NBC News reporting an average wholesale price of $900 for a 30-day supply. Pharmacies stocking the drug have found insurance reimbursements do not cover the cost, which has resulted in many pharmacies deciding to stock the medication no longer. Examples like this are prevalent throughout the pharmacy. Having PrimeRx generate an analysis of drug category profitability can help owners/managers determine which drugs to hold in inventory and which should only be procured on a “patient-specific, as-needed” basis.

Refills Due

Ensuring patients refill their medications is essential to pharmacy profitability. This visibility into outstanding refills and the ability to reach out to affected patients can be an effective way to improve a pharmacy’s dispensing rate. PrimeRx provides this information via a “refills due” report that lists all medications due for refill. The report can be customized based on a wide range of preferences, including date range, facility, prescriber, and profit range. Pharmacists can have a comprehensive overview of all outstanding refills – and potential revenue opportunities.

Business Intelligence

Top Patients

A listing of patients who generate a high amount of profit for the pharmacy

Top Prescribers

A listing of prescribers who generate the highest number of prescriptions filled by the pharmacy and the profit generated by those medications

Drugs Dispensed

A listing of all drugs dispensed each month, including the profit generated by each medication. This report not only indicates the pharmacy’s most profitable drugs but also reveals medications that may be out of stock. Every savvy pharmacy owner knows, an out-of-stock medication is an opportunity – for a competitor

Vendor Management.

Pharmacies can know precisely which medications have been purchased from each wholesaler/vendor. The system carefully tracks inventory received from a particular vendor, with each medication – and supporting information — scanned and stored within a vendor’s record.

• EDI/Automatic Reordering: Once the quantity of medication reaches a predetermined level, PrimeRx will automatically submit a reorder request.

• EDI/Purchase Order Generation. The system allows pharmacies to create online purchase orders that are electronically transmitted to a supplier

Reporting.

Extensive reporting capabilities on inventory-related topics, including:

- Inventory Status Report – A comprehensive overview of inventory holdings on a drug-by-drug basis.

- Inventory Consumption – Shows inventory received versus inventory dispensed over a selected time frame.

- Physical Inventory Sheet – Printable listing of drug holdings that can be validated by pharmacy staff during site checks.

- Inventory Received – Documents each shipment of drugs entered into PrimeRx.

- Physical Inventory Report. Documents each time a physical inventory has been completed.

- Drug Inactivity Report. Documents drugs that have not been dispensed over a selected period of time.

- Drug Activity Report. Depicts the movement of drugs during a selected time.

- Unused Activity Report. Builds on the “drug inactive” report to offer more specific details about drugs that have not been dispensed during a selected time value.

- Average Consumption Report: Shows daily, weekly, and monthly usage on a drug-by-drug basis.

- Inventory Reconciliation. Serves as a “master” report that details any discrepancies between physical inventories and system accounts. This gives the pharmacy an opportunity to investigate and locate the source of any discrepancy and make sure all accounts are in sync.

Real-Time Prescription Benefit

Staff Productivity

Inventory is the most significant carrying cost for an independent pharmacy, accounting for nearly 70% of expenses according to PBA Health. In fact, the NCPA Digest found the average cost of for an independent pharmacy exceeds $230,000 every month.

With such a direct – and dramatic – impact on the bottom line, pharmacists must prioritize inventory management. This means knowing precisely which drugs are on the store shelves, how much they cost, and how soon they are likely to be dispensed. PrimeRx facilitates complete inventory visibility with capabilities that include

Workflow Management

Centralized records management and storage.

Pharmacy managers can have confidence that all records – patient, vendors/suppliers, compliance, inventory, operations, sales, claims, reimbursements – are seamlessly stored within PrimeRx. This capability is especially helpful when responding to audit inquiries since requested documents can be located in a matter of seconds, eliminating the need for staff members to comb through boxes of documents.

Daily Log

This is a daily summation of all activity that takes place in the pharmacy. A pharmacy owner/manager can customize a report based on personal preferences, but fields include prescriptions processed, drug type, patient type, and staff productivity rates. The daily log is a fast way for pharmacy owners to obtain a quick overview of the pharmacy’s daily activities. The log generates a pharmacy signature/ authorization area, which can be used to validate the report for compliance and audit purposes.

Conclusion

References

-

Allen, Arthur, “Biden’s limit on drug industry middlemen backfires, pharmacists say,” CBN News, November 14, 2023.

-

Gebelhoff, Robert, “The U.S. pharmacy industry is crumbling. Here’s how to fix it,” The Washington Post, November 27, 2023.

-

“How to Offset DIR Fees and Increase Pharmacy Profitability,” Digital Pharmacist, 2023.

-

Loria, Keith, “Upcoming DIR Fee Changes Still Causing Concern for Pharmacists,” Drug Topics, August 12, 2023.

-

Lovelace, Berkeley, and Abou-Sabe, Kenzi, “Ozempic shortages? Some pharmacists are choosing not to stock the drug at all,” NBC News, March 2, 2023.

-

“National Community Pharmacists Association (NCPA) Frequently Asked Questions about Pharmacy ‘DIR’ Fees,” National Community Pharmacists Association, accessed February 1, 2024.

-

“Small Business Snapshot,” U.S. House Committee on Small Business, U.S. House of Representatives, January 17, 2024.

-

“The Data Paradox,” Dell Technologies, 2020.

-

“Understanding Pharmacy Reimbursement Trends in Oregon,” Oregon State Pharmacy Association press release, October 27, 2022.

Talk to an Expert!

With PrimeRx, pharmacy workflow tasks can be automated, leaving more time for pharmacists to engage with patients and focus on other pharmacy matters.